Demystifying the CIBIL Credit Score: Understanding its Importance and Functionality

When you don’t know anything about personal finance, yet you might need a personal loan urgently, you will come across this term for sure – CIBIL score.

Yes, the CIBIL score is your guiding light in personal finance. It highlights your creditworthiness and financial potential.

As an Indian, you might be navigating a diverse financial journey. And hence, an understanding of the significance and workings of the CIBIL credit score is paramount.

This comprehensive guide embarks on a journey to demystify the intricacies of this critical metric.

So let’s dive deep and unravel the importance and functionality of the CIBIL credit score against the dynamic financial landscape of India.

But before all, let’s try to understand what this metric is.

What is the CIBIL score?

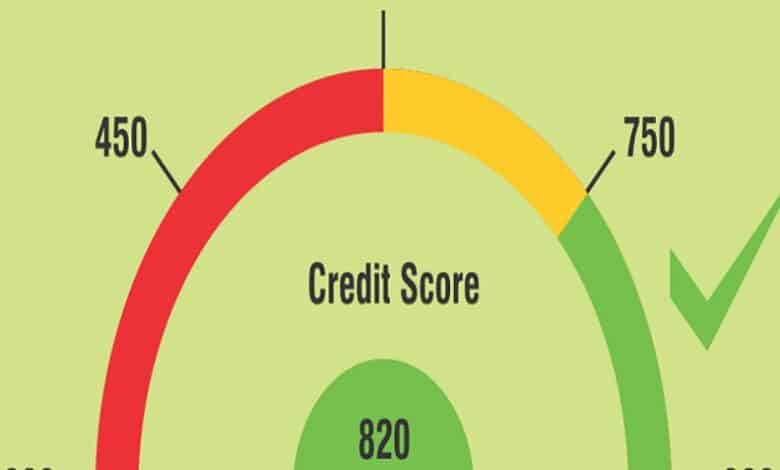

Your CIBIL (Credit Information Bureau India Limited) score is a three-digit numerical representation ranging from 300 to 900.

It serves as a measure of your creditworthiness, assessing your ability to repay borrowed funds.

The higher your CIBIL score, the more favorably you are viewed by lenders like banks and NBFCs, and it opens multiple doors for better financial opportunities.

How is the CIBIL Score Different from Other Credit Scores?

While the CIBIL Score is a well-recognized credit metric in India, there are other credit bureaus like CRIF, Equifax, and Experian that also provide credit scores.

However, each bureau may use slightly different algorithms and data sources to calculate scores. This can lead to variations in the scores provided by different bureaus.

It’s essential to note that lenders in India predominantly rely on the CIBIL Score, making it a vital point of reference for credit decisions.

It’s a comprehensive reflection of your credit behavior – aggregating data from various financial institutions and painting a holistic picture of your creditworthiness.

While CRIF, Equifax, and Experian are gaining prominence, the CIBIL Score remains the industry standard and most widely used credit scoring model.

Why is the CIBIL Score Considered a Critical Metric – Reasons Behind Its Importance

The CIBIL Score holds paramount importance due to the following reasons.

1. Loan and Credit Card Eligibility

Lenders across India use the CIBIL Score as a primary determinant for granting loans and credit cards. A high score enhances your eligibility and expedites the approval process.

It’s true that most banks and NBFCs will reject your credit card application if your CIBIL score is below 750.

2. Interest Rates

A strong CIBIL Score enables negotiation for lower interest rates on loans and credit cards, reducing your overall cost of borrowing.

3. Increased Loan Amount

Having a very healthy CIBIL score enhances your chances of obtaining a bigger loan amount from any bank or NBFC.

You will get access to pre-approved loans as well!

4. Discounts

A good CIBIL score will ensure you get discounts on specific charges and processing fees.

5. Financial Opportunities

Beyond credit, a high CIBIL Score positively impacts other financial aspects, such as rental agreements for houses and apartments, job applications, and insurance premiums.

This is because, ultimately, it reflects your credibility in repaying borrowed funds in time.

What are the Factors on Which the CIBIL Score is Dependent?

The CIBIL Score is calculated based on several factors, like the ones we are mentioning below.

1. Repayment History

Timely payments of loans and credit card bills have a significant impact on your score.

2. Credit Utilization

Keeping credit card balances low and manageable enhances your score.

3. Credit Mix

A diverse mix of credit types, such as loans and credit cards, can improve your score.

4. Credit Duration

A longer credit history showcases responsible credit behavior and positively affects your score.

5. New Credit Applications

Frequent applications for new credit within a short span can negatively impact your score.

Why Should You Stay Updated with Your CIBIL Score Always?

Regularly monitoring your CIBIL Score offers several advantages. You should always keep a tab on your updated CIBIL score for these reasons.

1. Error Detection

Regular checks help identify and rectify inaccuracies or discrepancies in your credit report that could affect your score negatively.

2. Proactive Measures

Early awareness of score fluctuations allows you to take corrective actions to maintain or improve your creditworthiness.

3. Financial Planning

Keeping track of your score helps you plan your financial activities, ensuring preparedness for credit applications.

What are the Various Functionalities of Your CIBIL Score?

You will be awed at the range of functionalities that the CIBIL score offers. The CIBIL Score serves multiple functions, such as those listed below.

1. Credit Approval

Lenders use the CIBIL Score to gauge your creditworthiness, influencing loan and credit card approvals.

2. Interest Rates

A higher score translates to lower interest rates, reducing the financial burden of borrowing.

3. Credit Limit and Amount

A strong score often leads to higher credit limits and loan amounts, providing financial flexibility.

4. Loan Terms

Lenders may offer more favorable terms and conditions to individuals with higher CIBIL Scores.

5. Negotiating Power

A good score grants you negotiation leverage when seeking loans, credit cards, or other credit facilities.

In essence, the CIBIL Score is a powerful tool that shapes your financial journey, impacting your ability to access credit, the terms you receive, and the financial opportunities that come your way.

Staying attuned to your score, understanding its intricacies, and nurturing a healthy credit profile can pave the way for a brighter financial future.

What is a Good CIBIL score?

Let’s follow this range of your CIBIL score and find out which can be considered good for your financial requirements.

| Range | Status |

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very Good |

| 800 – 900 | Exceptional |

Although a CIBIL score above 680 is considered really good, in order to get all your loan and credit card applications approved, you must focus on keeping your CIBIL score always above 750.

How Can You Improve Your CIBIL Score?

If the prospect of achieving a stellar credit profile feels distant, take heart – there are concrete steps you can take to elevate your CIBIL score and unlock a realm of possibilities that a higher score brings.

Elevating your credit score beyond 750 is within reach, and it can grant you access to better financial opportunities.

1. Monitor Your Credit Report for Errors

Regularly scrutinizing your credit report is essential to identify any inaccuracies.

Sometimes, credit reports may fail to update a loan you’ve already repaid, affecting your credit score.

Vigilance is key; spotting such errors empowers you to approach credit bureaus for necessary corrections, ensuring your score accurately reflects your financial behavior.

2. Timely Repayment

The cornerstone of a responsible and creditworthy image is the consistent and punctual repayment of all loan EMIs, bills, and other debts.

You must also clear any outstanding dues or bills.

Banks place significant weight on this factor when considering your loan applications and determining the interest rates offered.

Meeting your repayment obligations demonstrates your financial reliability and strengthens your creditworthiness.

3. Strategic Loan Repayment Periods

While the impulse to expedite loan repayment is strong, consider opting for longer loan repayment periods when uncertainty looms.

Opting for extended repayment durations translates to lower monthly installments, reducing the risk of default.

A steady repayment schedule enhances your credit profile, affirming your ability to manage credit responsibly.

4. Preserve Older Credit Cards

Don’t be hasty in discarding your older credit cards, even if novelty beckons.

Retaining old credit cards, especially those associated with a positive credit history, holds value.

Lenders view your older credit cards as a testament to your responsible financial behavior, enhancing your credibility as a reliable borrower.

5. Minimum Credit Inquiries

When you are already repaying multiple loans and credit card debts, making additional loan inquiries reflects your poor financial situation.

Hence, it can be assumed that your credibility as a borrower will decrease. As a result, your CIBIL score also decreases.

So if you don’t make additional loan applications and credit inquiries, your CIBIL score will remain healthy.

6. Don’t Exhaust Your Credit Limit

Whether it be your credit card balance or a line of credit from which you are currently siphoning funds, never exhaust them fully.

If you keep some balance and start repaying the rest responsibly, your CIBIL score will improve periodically.

Embracing these pragmatic measures can set you on a transformative journey to bolster your CIBIL score.

Bottom Line

As you navigate the intricate world of personal finance in India, the CIBIL credit score appears as your guiding compass!

Yes, it will steer your financial decisions towards impeccable success.

With a profound understanding of the importance and functionality of the CIBIL credit score, you hold the keys to unlock a world of immense financial possibilities!