The impact of MSME loan interest rates on profitability

In recent years, India has witnessed a surge of entrepreneurial spirit that has taken the country by storm. Today, it seems like everyone has a startup idea tucked away in their back pocket, waiting for the right opportunity to bring it to life. People from all walks of life, across different age groups, and with varied backgrounds are now looking for ways to turn their ideas into reality.

The startup culture has become so pervasive that it has led to many people leaving their regular jobs to chase their entrepreneurial dreams. The allure of being your own boss, creating something new, and making a difference in the world has prompted many to take the plunge and dive headfirst into the world of startups.

These business enterprises or MSMEs play a vital role in the growth and development of any economy. In India, they contribute significantly to the country’s GDP and provide employment opportunities to millions of people. According to the Indian Brand Equity Foundation (IBEF), the number of MSMEs increased by a compound annual growth rate of 18.5% from 2019 to 2020.

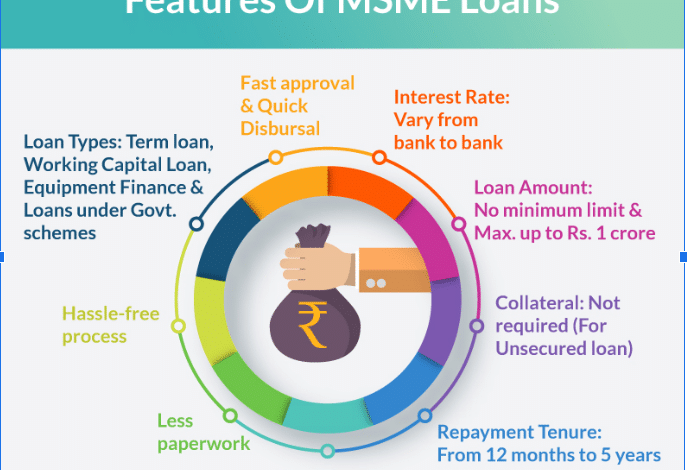

To promote MSME business loan in India and make it more accessible, the Government of India partnered with the Reserve Bank of India (RBI) and the Small Industries Development Bank of India (SIDBI) to launch the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme, which provides collateral-free loans to MSMEs. As per another report by IBEF, during FY21, MSME business loan disbursals increased by 40% to reach ₹9.5 trillion, as compared to ₹6.8 trillion in the previous financial year, reflecting a significant rise.

These business enterprises face various challenges, including the availability of finance. MSMEs often rely on loans to finance their operations, and the interest rateson these loans can significantly impact their profitability.

Another factor that influences interest rates is the type of loan. Secured loans, such as those backed by collateral, tend to have lower interest rates than unsecured loans. Businesses that can provide collateral may be able to negotiate lower interest rates, as the collateral provides security for the lender. The loan amount and repayment period can also impact interest rates. Entrepreneurs should consider the amount they need to borrow and the repayment period when applying for loans, as these factors can impact the cost of borrowing.

However, the impact of high-interest rates on startups cannot be ignored. To address this issue, the government has taken several steps to make it easier for MSMEs to access finance. For example, the government has launched the Pradhan Mantri Mudra Yojana (PMMY), which provides loans to MSMEs without collateral. These initiatives have made it easier for MSMEs to access finance, but interest rates remain an issue. As a solution, entrepreneurs must be aware of the factors that influence interest rates and how they can negotiate better rates.

One of the main facors that influence interest rates is the creditworthiness of the borrower. Banks and financial institutions consider several factors when assessing creditworthiness, including the borrower’s credit score, income, and repayment history. Entrepreneurs can improve their creditworthiness by maintaining a good credit score, paying bills on time, and maintaining a steady income.

In recent years, the Government of India along with other financial institutions like banks has taken several initiatives to promote MSMEs’ growth, including making it easier for them to access loans. However, despite these efforts, MSMEs still face challenges in accessing finance, particularly regarding high-interest rates. The interest rate on an MSME business loan has a significant impact on profitability, and it’s essential for entrepreneurs to understand how interest rates work and how they can impact their business’s bottom line.

Thanks to banks like Karnataka Bankoffering you up to ₹200 lakhs (subject to the terms and conditions of the bank) on the loans eligible to be covered under CGTMSE, you no longer have to worry about the finances to kickstart your business and see it grow in leaps and bounds. So wait no more and turn your entrepreneurial dream into a reality today by taking the right step with the best small business loans of your choice!