Concerning long-term business achievement, readiness is the situation. Moreover, a solid financial plan is a way into that readiness. It assists you with pitching financial backers, expects development, weather conditions, and income deficiencies. To begin, you want to gain proficiency with a portion of the vital components of financial planning.

What is a Financial Plan?

A financial plan decides whether a thought is practical and afterward keeps you on target for monetary wellbeing as your business develops. It’s an indispensable part of a general marketable strategy and comprises three financial statements — cash flow, pay statement, and balance record. In your arrangement, every one of these will incorporate a short clarification or analysis.

The Importance of a Financial Plan Important to Your Small Business

A professional financial planner can assist you with accomplishing more important trust in your business while creating a superior comprehension of how to distribute assets. It shows your business is focused on spending astutely and it’s capacity to meet monetary commitments. A financial plan assists you with deciding whether decisions will influence income and which events call for dunking into hold reserves.

It’s additionally a significant device while requesting that financial backers think about your business. Your financial plan shows how your association oversees expenses and produces income. It shows where your business stands and the amount it needs from sales and financial backers to meet significant monetary benchmarks. Now, you know the importance of financial plans for small businesses.

Parts of a Small Business Financial Plan

Whether you’re changing your arrangement or beginning without any preparation, a financial plan in a business plan ought to include the following:

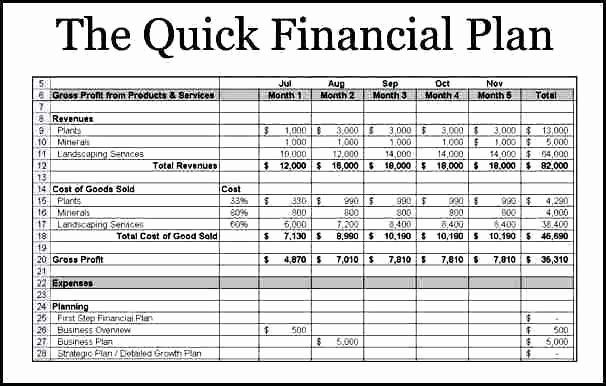

Income Statement

It shows how your business experienced profit or misfortune over a particular period — commonly north of 90 days. Otherwise called a benefit and-misfortune explanation (P&L) or expert income statement, it records the accompanying:

- Cost of the offer or price of products (what amount does it expenses to create your services and products?)

- Operating costs like lease and utilities

- Revenue streams, ordinarily as sales

- Amount of total net benefit or shortfall otherwise called a gross margin

Balance Sheet

Why have a balance sheet? It can give knowledge into your business and show significant measures like the amount of money you possess, your commitments, and the sort of benefit you’re making.

Personnel Plan

You want the ideal individuals to meet objectives and hold a solid income. A faculty plan takes a gander at existing positions and assists you with seeing when now is the right time to welcome in more colleagues and whether they should be full-time, part-time, or work on a legally binding premise. It sees pay levels, including advantages, and figures those expenses. By taking a gander at development and costs, you can check whether the potential benefits accompanying another worker legitimize the cost.

Business Ratios

Sometimes you want to check out something other than the 10,000-foot view. You want to bore down to explicit parts of your business and watch out for how individual regions are doing. Business proportions are a method for seeing your overall net revenue, return on value, turnover of creditor liabilities, resources for deals, working capital, and all-out obligation to add to resources. Numbers used to work out these proportions come from your P&L explanation, balance sheet, and cash flow statement. In many cases used to assist with mentioning subsidizing from a bank or financial backers.

Sales Forecast

What amount will you sell in a particular period? A sales figure should be a continuous piece of any arranging cycle since it predicts income and the association’s general wellbeing. A figure should be steady with the marketing projection inside your P&L explanation. Coordinating and sectioning your business conjecture will rely on how completely you need to follow sales and your business. For instance, if you own an inn and giftshop, you might need to independently follow deals from visitors remaining the evening and sales from the shop. It is a must for financial plans for small businesses.

Cash Flow Projection

Maybe one of the essential parts of your monetary arrangement is your income proclamation. Your business runs on cash. Understanding how much money is coming in and when to expect it shows the contrast between your benefit and money position. It should show how much money you have now, where it’s going, where it will come from, and a timetable for every action. It will help you manage your financial plan for a small business.

Income Projections

How much cash will your organization make in a given period, generally a year. Then, deduct the expected costs, and you’ll have the pay projections. At times, these are moved into loss and profit statements.

Assets and Liabilities

Both of these components are important for your asset report. Resources are what your organization possesses, including current and long-haul resources. Current resources can be changed over into cash soon. Consider things, for example, stocks, stock, and records receivable. Long-haul resources are substantial or fixed resources intended for long-haul utilization, like furnishings, apparatuses, structures, hardware, and vehicles.

Liabilities are business commitments that are separated into current and long-haul classes. Instances of current liabilities in a monetary arrangement are gathered finance, charges payable, transient credits, and different commitments due soon. Long-haul liabilities incorporate investor credits or bank debt that develops over a year after the fact.

Break-even Analysis

Your break-even point — the amount you want to offer to cover every one of your costs — will direct your business income and volume objectives. Begin by working out your commitment edge by deducting the expenses of a decent or administration from the sum you pay. Because of a bike store, the deal cost of another bicycle is less than what you paid for itself and the compensation of your bicycle salesman, your lease, and so on. By understanding your allowable expenses, you can start to comprehend the amount you’ll have to markup labor and products and what sales and income objectives to put together to remain above water or make money. It is all you need to add to your financial plans for small businesses.