How to Choose the Best Mutual Funds to Invest?

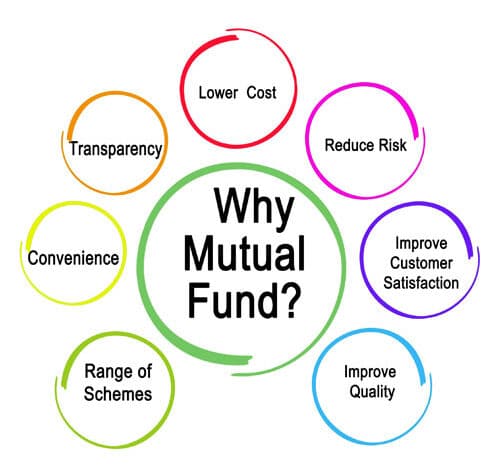

The mutual fund has immense popularity in the investment sector and you need to go with the best mutual fund to invest in.

Many people considered mutual funds as the ultimate investment strategy from diversifying risk to reducing paperwork. Also, it pays to do your research to identify the best out of the best mutual funds.

When it comes to introducing the funds into your investment portfolio, it is important to keep a few essential tips in mind to make the best choice. Therefore, today in this guide we will discuss the ways to choose the best mutual funds for your investment goals.

Ways to Choose the Best Mutual Funds to Invest

- Consider Your Investment Objectives: First of all, consider your investment objectives before investing in any mutual fund. Choose the amount of money you are ready to invest, and also know about the return on investment you are targeting.

Plan about how long you decided to stay invested. Knowing all this will help you in determining the list of potential mutual fund that fits perfectly in your investment goals.

- Evaluate Fees and Expenses: On your overall returns, the mutual fund fees and expenses can have a huge amount of impact. Investors can increase the bang for their buck with the help of selecting the right funds with lower costs and also understanding the expanses and fees structure.

Generally, it is seen that the funds with low expenses and fees are more likely to outperform those with higher expenses or fees over time.

- Research the Fund Manager: In the performance of a mutual fund, the fund manager plays an important role. Therefore, it is necessary to research the fund manager’s past performance rate as well as the investment philosophy.

To check whether they are a good fit for your investment strategies or not, it is important to learn about their experiences and background.

- Understand the Fund’s Investment Style: Investors should know everything about fund investment type and style if they are looking for the perfect fit for the portfolio. This can be a good decision to make.

When the fund is invested, investors should know about various types of securities and assets, also about the risk it has, as well as the sector emphasis, and so on. This enables one to know whether it is good for the investment goals or not.

- Compare Similar Funds: Investors should compare similar funds to know everything about the performance of funds over time and how it will suit their portfolio.

Try to use the information related to the past performance of the fund manager, the risk level, expenses and fees required, and so on things to compare the funds.

- Check the rates of mutual funds: Investors should always check the rate of mutual funds before investing in them because it gives them an idea about past performance, expenses, and other things to invest in to get a high investment amount. It allows the investors to compare it with the other types of funds.

Conclusion

It is a challenging choice to choose the best mutual fund to get invested in, especially for uninitiated investors. But with the help of a few factors research such as risk level, funds, and their types, return level, and fees in mind, investors can make a wise choice.

Investors need to stay parallel with the new developments as the Indian mutual funds markets are improving and keep evolving. This is important for the right decision to meet the required goals and needs.