Portfolio Management Services for Retirement Accounts

Portfolio Management Services (PMS) have become increasingly popular among investors who want professional management of their portfolios. PMS providers offer customized investment solutions based on the client’s investment objectives, risk tolerance, and financial goals. This type of service is particularly beneficial for investors planning for retirement. In this blog, we will discuss PMS for retirement accounts and the benefits they offer.

PMS for Retirement Accounts

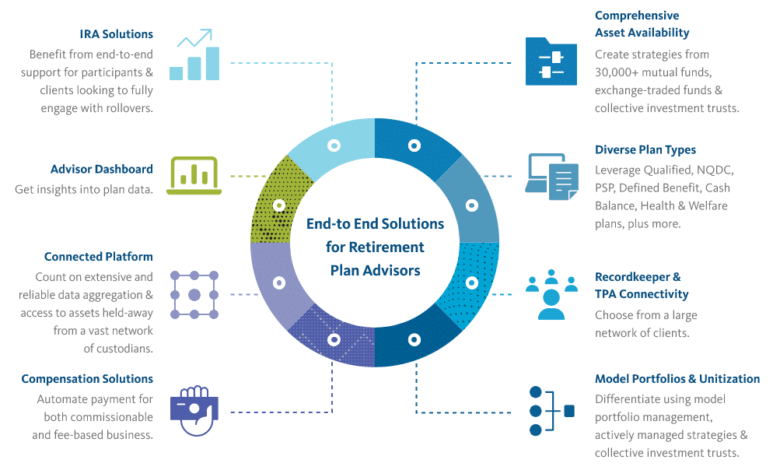

Retirement accounts differ from regular investment accounts because they have a longer investment horizon and require a different investment strategy. PMS for retirement accounts are designed to help investors manage their retirement portfolios efficiently. PMS providers can help investors diversify their retirement portfolio by investing in different asset classes, such as equities, fixed income, and alternative investments. PMS providers also offer regular monitoring and rebalancing of the portfolio to ensure that it remains aligned with the client’s investment objectives and risk tolerance.

Benefits of PMS for Retirement Accounts

Professional Management

PMS providers have a team of professional investment managers experienced in managing retirement portfolios. They have the knowledge and expertise to design a retirement portfolio that meets the client’s investment objectives and risk tolerance. Professional management can help investors achieve their retirement goals by maximizing returns while minimizing risks.

Diversification

Diversification is crucial for retirement portfolios as it helps to reduce risks and ensure that investments are not concentrated in a single asset class or sector. PMS providers can help investors diversify their retirement portfolios by investing in various asset classes. Diversification can also help minimize market volatility’s impact on the portfolio.

Risk Management

PMS providers are experienced in managing risks associated with retirement portfolios. They can help investors manage market volatility, inflation, and interest rate risks. PMS providers can also help investors manage the sequence of return risks, which is the risk of experiencing negative returns in the early retirement years.

Customization

PMS providers can customize retirement portfolios based on the client’s investment objectives, risk tolerance, and retirement goals. They can help investors design a portfolio that meets their needs and preferences. PMS providers can also help investors adjust their portfolios as their investment objectives and retirement goals change.

Regular Monitoring and Rebalancing

PMS providers offer regular monitoring and rebalancing of the retirement portfolio. Regular monitoring can help ensure the portfolio remains aligned with the client’s investment objectives and risk tolerance. Rebalancing can help to manage risks associated with asset class drift.

Choosing a PMS Provider for Retirement Accounts

When choosing a PMS provider for retirement accounts, it is essential to consider several factors, including:

Reputation

Choose a PMS provider with a good reputation in the market. Look for a provider with a track record of delivering good investment results and managing risks effectively.

Experience and Expertise

Choose a PMS provider with experience and expertise in managing retirement portfolios. Look for a provider with a team of experienced investment managers knowledgeable about retirement planning and investment strategies.

Fees

Compare fees charged by different PMS providers before choosing one. Look for a provider that charges reasonable fees and provides value for money.

Investment Philosophy

Choose a PMS provider whose investment philosophy aligns with your investment objectives and risk tolerance. Look for a provider with a clear investment process and a disciplined approach to investing.

Conclusion

PMS for retirement accounts offers several benefits, including professional management, diversification, risk management, customization, and regular monitoring and rebalancing of the portfolio. When choosing a PMS provider for retirement accounts, it is essential to consider several factors, including reputation, experience and expertise, fees, and investment philosophy