[2022] 10+ Best Share Market Books to learn share market

Friends, if you want to become a share market expert, then you should read Share Market Books, by reading these books, you can learn more about the stock market. Here we have explained about 18 Share Market Books in detail. By reading which you can be successful in the share market.

[2022] Top 10+ Best Share Market Books

Here is the list of Top 10+ Best Share Market Books which you can purchase for learning Share Market.

#1. The Dhanho Investor

The first book in the list of Share Market Books In Hindi is The Dhandho Investor This book is written by Mohnish Pabrai This book was written in April 6, 2007 This book is very favorite of investors because it has been told that how we can get more return with work risk.

This book is a very good book from the point of view of knowing the stock market better, it can make your value investing talent more efficient, it has a very good and interesting story which you will get to learn something by reading it. So let’s go through the summary of The Dhandho Investor Book.

The Dhandho Investor Book Summary

The Dhandho Investor book describes how some Gujarati Patels went to America and made more money by investing less money there.

So the matter is in 1973, when the price of petrol in America increased so much that the people there stopped roaming, so the business of the motel built on the highway started going into loss, which the owners of those motels started selling the motel. But Gujarati Patels knew that the petrol crisis would end soon, they started buying those motels by taking a loan from the bank and investing some of their savings. Diya and the business of his motel started running.

Similarly, he had made a big business by investing less money, just like if you do in the share market, then you can also make more profit.

What can you learn from The Dhandho Investor book?

- This book tells you about value investing

- Teach you how to make high returns with less investment.

- How to get more returns with less risk Do it.

- How to invest when a good opportunity comes, which will lead to more profit.

The Dhandho Investor book can be purchased by clicking on the button below

#2. Learn To Earn – Stock Market Book For Beginners

Learn to Earn book is one of the very best stock market books for beginners. This book by Mr. Written by Peter Lynch. This book was published in 1995, its author Peter Lynch has given you Share Market Guide in Hindi in this book, but this book is in English but you can also read its Hindi translation.

If you are a beginner then this book is of great use to you, in this you have been told about the basic rules of share market. In this book, you have been explained very well about the stock market and economy. So let’s know the summary of Learn to Earn book.

Learn To Earn Book Summary

In this book, the author has told about how the US economy started from zero and became the world’s largest economy. Also, he told how the money invested in the share market helps our economy and the economy of the country starts growing soon.

Apart from this, in this book, he has given complete history of stock market i.e. what is share market, how stock market started and what things should be kept in mind while investing in share market. discussed.

Learn To Earn Growth of share market and economy has been explained in great detail in the book and you can also learn from this book how an investor should invest. This book is specially for beginners in the list of stock market books in hindi.

What can you learn from the book Learn To Earn?

- This book teaches us how we can help the economy of the country by investing our money.

- If you want to learn the basics of share market then you can read this book. We can learn from the book.

- Through this we can learn about how to make the right investments and make more profit on our money.

Learn To Earn book you can buy by clicking on the button below

#3. Stocks To Riches

Stocks To Riches is one of the best stock market books for beginners in India This book was published in the year 2005 after which it became the favorite book of investors. The author of this book Mr. Parag Parikh Hai, he was a successful value investor.

In Stocks To Riches he has explained very well about Investing Basics, Behavioral Finance, Traders and Investors Psychology. Things will be learned. Let us now know the summary of Stocks To Riches Kitba.

Stocks To Riches Book Summary

The author has told about Investment Behavior in this book, in which he has discussed five rules. In the first rule in the author, how people sell their good returns giving stock to compensate for the loss and we invest in the stock in which the loss is happening.

In the second rule, he has told how an investor starts buying the same stock to make up for the loss in his stock, while this is the wrong way. Now the author has told in the third rule that how to make decisions by being emotional, which increases the chances of them getting hurt.

Now out of the five rules mentioned in the article, he tells in the fourth rule that people do not sell their stock at the right time because of greed, which later reduces the value of that stock and the investor suffers. In the last rule, the author says that when we have knowledge about something, then we are not able to take any decision about that thing, due to which we sit at the right time by not taking the right decisions.

What can you learn from the book Stocks To Riches?

- This teaches us that we should never get greedy while investing.

- The author has told through this book that we are never constantly underperforming. Should not invest in stocks.

- If you want to take share market guide in Hindi then definitely read this book because in this we have understood that we should take right decisions at right time.

Stocks To Riches You can buy the book by clicking on the button below

#4. Romancing The Balance Sheet

The fourth book in the list of Share Market Books In Hindi is Romancing The Balance Sheet and it is written by Mr. Written by Anil Lambha, this book was published in 2016, since then this book is very special for stock market investors and traders.

This book talks about Balance Sheet. If you do any business or invest in the stock market, then you must read this book, in which you have been understood about the balance sheet in many ways. Even if you are from commerce background then this book is for you. Let us now know the summary of the book Romancing The Balance Sheet.

Romancing The Balance Sheet Book Summary

The author has explained in detail about balance sheet in this book, basics of balance sheet, how balance sheet is prepared, how balance sheet is drawn, which things should be more attention in balance sheet and balance Some rules related to the sheet are understood in this book.

The author wants to tell through this book that before buying the shares of a company, people must see the balance sheet of that company, so that investors will get all the information about the company and if a person wants to do his business, then from him How to prepare your balance sheet. Financial statements of companies are explained very simply.

What can you learn from the book Romancing The Balance Sheet?

- In this you can learn about all the information related to balance sheet of companies.

- This book is best to get share market guide in Hindi in which you can invest in companies.

- After reading this book, you start thinking like a financial person instead of a non-financial person.

- This is you. You can learn about how to manage the balance sheet of your business.

Romancing The Balance Sheet book you can buy by clicking on the button below

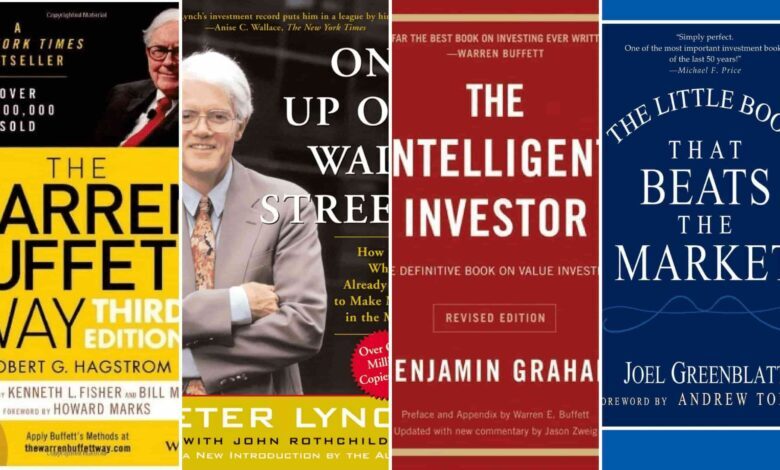

#5. One Up On Wall Street

One Up On Wall Street is considered a good book for investors in the stock market, it is Mr. Written in Petter Lynch and published in 1989. This book should be read by every investor because in this you have been told about how to invest in the stock market by finding good companies.

In this book, it has been told about how to analyze the company, apart from this, what are the types of company according to your growth, how to find good companies to invest in the share market, as well as they have done their lot. We have also discussed about the mistakes, which you can invest without doing and you can be successful in the share market.

This book is very popular in the list of share market books in hindi which every investor likes to read. Let us now know the summary of the book One Up On Wall Street.

One Up On Wall Street Book Summary

The author has told in this book that first you stop listening to the professional and earn money by using whatever you know. Apart from this Mr. Petter Lynch says that any person can use their 3% brain to pick good stocks and earn good returns.

The author has told in this that how he chooses good stocks which give multibagger returns, apart from this he told how by understanding the business of a company and investing in that company, money can be increased in the coming time. You can invest in more good companies.

The author makes a category of companies before investing in a company, in which he divides the companies into 6 different categories and then recommends investing in fast growth companies.

Whenever you do a detail analysis of a company, you get to know about the business, profit and loss of that company, which helps in investing in that company.

What can you learn from the book One Up On Wall Street?

- In this you get to learn how anyone can earn good money even by using his little knowledge, sir you have to invest in a company whose business you know very well.

- Here it is said that you should always invest in the company only after looking at the growth of the company so that you can get good returns.

- li>

- Before investing in any company, you must know about its business.

You can buy the book One Up On Wall Street by clicking on the button below

#6. The Warren Buffett Way – Warren Buffett Ke Nivesh Ke Rahasy

The name of the next book in the list of Share Market Books is The Warren Buffett Way This book is written by Mr. Written by Robert G Hagstrom, this book was published on 12 November 2004. Well, this book is in English but you can read its Hindi translation which is Warren Buffett Ke Nivesh Ke Rahasya.

In this book, we have told about many ways, with the help of which you can find good stocks and invest in them. This book is a Newyork Times Bestseller in which Warren Buffett’s investment strategy has been told. Let us now know the summary of The Warren Buffett Way book.

The Warren Buffett Way Book Summary

The author has explained in detail about Warnner Buffett’s investment strategy in this book, he has written how we can earn money by investing in undervalue stocks and selling them at the right time. Apart from this, he has also told about how to find undervalued stocks.

This book is based on how to earn profit in long-term investing, in which you can earn a regular income by investing for a long time.

The author has also told that if you make a loss then you should not panic and if you get more profit then you should not be too happy.

What can you learn from the book The Warren Buffett Way?

- You can learn about value investing from this book in which the author tells you how Warren Buffett picks his stocks.

#7. The Intelligent Investor

The Intelligent Investor book is also called the investors’ bible, if you know a little bit about the stock market then you should read this book. This book by Mr. Benjamin Graham wrote it in 1949 and the book is still a favorite of investors today. Mr. Benjamin Graham is called The Father of Value Investing.

Mr. Warren Buffett, the mentor of Benjamin Graham Warren Buffett, read this book at the age of 19.

The name of this book definitely comes in the list of Share Market Books In Hindi, if you want Share Market Guide in Hindi, then this book will be very useful for you, through this you can learn about many things. If settled, this book is written in English but you can also read the Hindi translation of The Intelligent Investor. Let us now know the summary of The Intelligent Investor book.

The Intelligent Investor Book Summary

Mr. Benjamin Graham has given four concepts in this book which an investor has to keep in mind. He writes that we should follow investing in Investing and Speculating because most people invest through others’ research while this is wrong.

It is written in the author, on the day there is a slowdown in the stock market, we should invest on that day and on the day the stock market is booming, those bought stocks should be sold. He says that run the market according to your own way, buy when people are selling and sell when everyone is buying.

He has written that always invest keeping in mind the margin of safety. Apart from this, he told that by investing in IPOs you will always get Over Valued Stock whereas if you invest in share market then you get Under Valued Stock easily, so most IPOs come only when there is a boom in the market. p>

What can you learn from the book

The Intelligent Investor?

- Always invest after your research.

- Invest in the stock market in your own way, buy when the market is down and sell when the market is up.

- Even if you invest in any stock, then invest in it only by keeping the margin of safety.

- Investing in IPOs you get expensive shares whereas in the stock market you get cheap and good shares.

The Intelligent Investor You can buy the book by clicking on the button below

#8. Technical Analysis Aur Candlestick Ki Pehchan

The last book in the list of Share Market Books In Hindi is Guide To Technical Analysis & Candlesticks, this book by Mr. Written by Ravi Patel which was published on 1st December 2010.

This book was written in English but you can read its Hindi translation Technical Analysis and Candlestick Ki Pehchan. In this book, you have been given information about the technical trader. Let us now know the summary of the book Technical Analysis Aur Candlestick Ki Pehchan.

Summary of the book Technical Analysis Aur Candlestick Ki Pehchan

The author has told in this book that how you can do share market analysis and find a good stock and invest in it, through many case studies, you have been told how you can do technical analysis with it. Loss theory and candlestick patterns are well explained.

With the methods mentioned in this book, you can do Intraday Trading and Swing Trading in a better way.

What can you learn from the book Technical Analysis Aur Candlestick Ki Pehchan?

- How to do Technical Analysis for Intraday Trading.

- Can learn about how to read Candelstick Pattern correctly.

- How to choose Stock Based on market analysis, you will learn through this.

You can buy the book Technical Analysis Aur Candlestick Ki Pehchan by clicking on the button below

Top 10+ Best Stock Market Books For Beginners

| Stock Market Books For Beginners | Authors |

|---|---|

| You Can Be A Stock Market Genius | Joel Greenblatt |

| Common Stocks and Uncommon Profits | Philip A. Fisher |

| The Compound Effect | Darren Hardy |

| Swing Trading Technical Analysis Hindi | Ravi Patel |

| Tradeniti : Kaise Bane Safal Professional Trader | Yuvraj S. Kalshetti |

| Intraday Trading Ki Pehchan | Ankit Gala & Jitendra Gala |

| Rich Dad Poor Dad | Robert T. Kiyosaki |

| How to Avoid Loss and Earn Consistently in the Stock Market | Prasenjit Paul |

| Value Investing and Behavioral Finance | Parag Parikh |

| The Psychology Of Money | Morgan Housel |

conclusion

So, friends, you can buy all the books in Share Market Books Some of these are stock market books for beginners from which you can learn the basics of the share market.

Now, This article ends, if you liked this article, then definitely share it with your friends so that they can also know about these Share Market Books.