The Impact of Economic Factors on Business Loan Interest Rates: How to Stay Ahead of the Curve?

Business Loan interest rate is a crucial aspect for all borrowers before applying for a loan. Every SME owner expects a high loan amount at the lowest possible interest rate. However, due to several reasons, they may not get it due to different lending institutions offering varying interest rates. Moreover, the interest rates keep changing from time to time based on numerous economic factors. Most importantly, the repo rate set by the RBI (Reserve Bank of India) drives the interest rates on Business Loans. Here, we will look at the link between economic factors and Business Loan interest rates.

The connection between Business Loan Interest Rates and the Repo Rate

Lending institutions borrow money from the RBI to lend loans to their customers. Why do finance companies borrow from the RBI? Well, they do not print money. So, they often fall short of capital when they have more applicants seeking loans. In such situations, their hand goes low on cash, and they borrow money from the RBI to fulfil the reserve requirements. The interest rate they pay to the RBI in exchange for the borrowed money is called the repo rate. The Business Loan interest rate they charge from their borrowers is a few percentage points higher than the repo rate to cover their costs and earn profit. Therefore, the repo rate largely impacts the interest rate borrowers pay on Business Loans.

Key Factors Determining the Repo Rate

The RBI reviews its repo rate every couple of months. When they increase the repo rate, the loan interest rate also increases and vice versa. However, why does the central bank keep changing the repo rate? Let’s look at the primary factors driving these changes.

- Inflation Rate in the Economy

The rate at which prices of products and services increase is called the inflation rate. A healthy economy usually undergoes a moderate inflation rate without pinching the consumers and supports business activity. However, a sharp increase in the inflation rate is not favourable for the country’s economy.

The inflation rate rising at a faster pace than citizens’ incomes will reduce their purchasing power, and they will need to cut down their expenses and consumption. Consequently, companies will face a downfall in their products’ demand, eventually slowing down the economy. Similarly, inflation rising at an extremely low pace is also detrimental to the economy. A low inflation rate indicates low product demand in the market, leading to reduced prices that harm the economy, increase unemployment, and discourage new investments.

So, the RBI is responsible for checking inflation rates to ensure steady growth in the economy. It aims to prevent a steep decrease or increase in inflation and maintain an inflation rate of 2-6%. Now, if the RBI foresees inflation to increase at a rate beyond 6%, it increases the repo rate to control the demand. It also increases the cost of borrowing for the lending institutions, which they pass to their borrowers by increasing their Business Loan interest rate. The increased interest rate pulls down the demand for new loans, thereby preventing inflation from spiking significantly.

Usually, economies do not witness a constantly low inflation rate. However, as already explained, it is not desirable as it leads to poor demand. If the central bank predicts subdued inflation, it reduces the repo rate, making Business Loans cheaper to borrow and encouraging more entrepreneurs to apply for a Business Loan. Considering the higher demand for borrowing, spending, and producing, the demand and price for goods also increase. However, other than the inflation rate, the RBI also considers several different factors while deciding the repo rate, including economic growth.

- State of Economy

The state of the country’s economy is a crucial factor determining the Business Loan interest rate. For instance, business owners are more financially confident in a growing economy. Hence, they are better prepared to invest in their business, employ more people, and boost their productivity with funds from a Business Loan. However, increasing demand for loans can boost inflation, due to which the RBI must increase its repo rate to curb inflation.

On the other hand, a slow economy makes business owners uncertain about their productivity and profits. As a result, they feel reluctant to invest money in their business, let alone employ more people, invest in marketing, restock inventory, expand the workplace, buy machinery, etc. For instance, companies had to cut down their operations during the covid-19 pandemic, resulting in cost-cutting and laid-off workers. In such conditions, businesses slow or shut down their growth and expansion plans resulting from poor demand. Consequently, the RBI reduces the repo rate to break the cycle and make borrowing more affordable. That boosts the demand for loans in the economy and encourages SMEs to make new investments in their businesses while taking advantage of cheaper capital.

How RBI Changed the Interest Rates in the Past?

A combination of all these factors supports the economy in recovery from a slowdown. As a result, the loan interest rates come down significantly, and business owners become more willing to apply for Business Loans. As the country’s growth slows down, the GDP and repo rate decrease too. The central bank tries to support the economy by changing the repo rate frequently. If the inflation rate goes higher than 6%, the central bank increases the repo rate to decrease the demand for loans.

Therefore, the inflation rate and the state of the economy are the two major economic factors affecting the Business Loan interest rate in India. The RBI must take a balanced approach to decide the repo rate and strike a balance between the two factors.

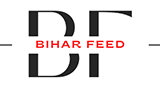

Besides these, lending institutions also consider several other factors while determining a loan applicant’s interest rate, including their credit score, annual turnover, business vintage and performance, business experience, nature of business, revenue and profit, repayment history, etc.

So, aspiring borrowers must improve their credit scores, reduce their debt obligations, and boost business finances to get a Business Loan at the best interest rate. Entrepreneurs looking to apply for a Business Loan must check the interest rates of various loan providers and opt for an offer that best suits their repayment capacity.